New accounts filed by RGRE Grafton Ltd show that €9.45m of last year’s €33.17m post-tax loss concerned receivership costs.

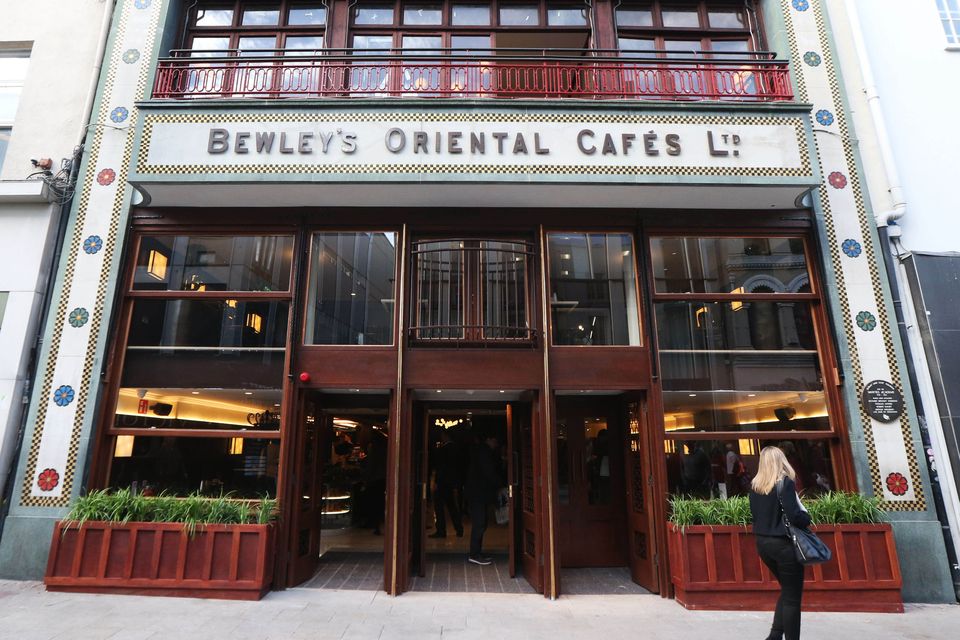

Last month, the Ronan Group confirmed the company had emerged out of receivership as part of a deal that allowed it take back what it called “the jewels in the crown” of the portfolio: 70 Grafton Street, home to PTSB and City Break Apartments, and 78-79 Grafton Street, the location of Bewley’s Cafe, in Dublin 2.

A note attached to the new accounts for RGRE Grafton Ltd shows that included in the €33.17m loss was a €15.54m loss on the disposal of investment properties and a latent capital gains tax (CGT) charge of €4.5m.

The loss also takes account of a €2.9m gain in the value of the property portfolio.

The note states that the company owed €38.59m to a credit institution and €67.25m to group companies of which €39.75m is reflected as subordinated loans.

The note adds that in November 2023, as a result of high interest rates and a significant decrease in commercial property values, which gave rise to bank covenant issues, the directors invited its senior lender, Bank of Ireland, to appoint a receiver over the secured assets.

Bewley’s on Grafton Street, Dublin

During 2024, the receiver marketed the company’s investment properties for sale and following this process two properties were sold for €18.45m.

In addition, the company acquired a property in 2024 for €10.3m from a company within the same corporate group, and subsequently sold it to a third party.

“Combined sale proceeds were used to part repay the senior lender’s loans and pay receiver and sales costs,” the note states.

In November 2024, the receiver entered into an agreement with another entity within the same corporate group for the sale of the company’s shares.

“Upon completion, the company had no further obligations to its previous lenders and successfully exited receivership.”

The directors believe that the company will be able to meet its obligations as they fall due.

Today’s News in 90 Seconds – April 29th

The book value of the company’s investment properties at the start of 2024 totalled €61.19m and was valued at €30.1m at the end of December 2024.

This was after disposals of €44.2m during the year and additions of €10.3m and the €2.9m gain in book value.

In February, the Supreme Court agreed to hear another appeal over the ownership of the Harry Clarke stained glass windows in Bewley’s Cafe in Grafton Street, Dublin.

It followed a 2-1 decision of the Court of Appeal last July that all six of the windows belong to the owner of the premises, RGRE Grafton Ltd.

A dissenting judgment found that two of the windows were owned by Bewley’s and the other four were “tenant’s fixtures”.

That decision differed from a 2023 High Court decision that only four of the windows belonged to RGRE while the other two were the property of the tenant, Bewley’s Cafe Grafton Street (BCGS) Ltd, and its subsidiary Bewley’s Ltd.

source